The Ministry of Defence (MOD), in its own words, is responsible for protecting the United Kingdom's "people, territories, values and interests at home and overseas".

With its expansive set of responsibilities, the MOD spent over £40 billion with private sector suppliers from January 2016 to the end of October 2021.

Understanding how, from whom and what the MOD procures is crucial if you're looking to do business with them, or want to cement your existing relationships.

Using Tussell's aggregated data platform, this blog provides an analysis of the MOD's procurement behaviour from January 2016 - October 2021.* Skip ahead to read about the MOD's:

-

Sector Case Studies (IT & Consulting)

-

Find our other Buyer Profiles here:

* Presented figures come from publicly available sources; due to the inherently secretive nature of some the MOD's activities, these figures do not reflect their true totals.

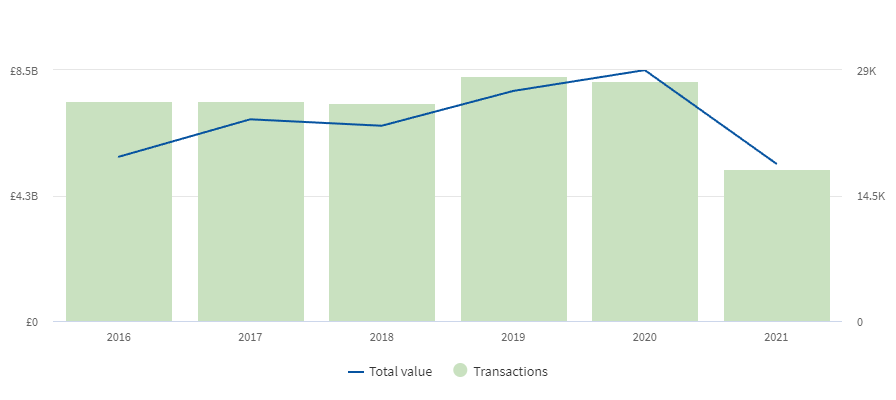

The MOD has spent approximately £40.6 billion with private sector suppliers since 2016, across nearly 150,000 transactions. This makes the MOD the largest public sector body by total invoice value, followed by Network Rail.

Excluding incomplete data from 2021, MOD spending has gradually increased over the past 5 years, rising from £5.6 billion in 2016 to £8.5 billion by 2020.

From 2016 - October 2021, the MOD largest suppliers by total spend were:

|

Supplier / Organisation |

Sector |

Total Invoice Value |

Largest Listed Contract |

Contract Value / Award Date |

|

BAE Systems Surface Ships |

Shipbuilding |

£2.87bn |

£230m / October 2019 |

|

|

Aspire Defence |

Facilities Management / Construction |

£2.35bn |

None publically listed. |

- |

|

Babcock Land Defence |

Defence |

£2.06bn |

None publically listed. |

- |

|

Leidos Europe |

Logistics |

£1.94bn |

£2.75bn / July 2017 |

|

|

Amey Defence Services |

Facilities Management / Construction |

£1.22bn |

None publically listed. |

- |

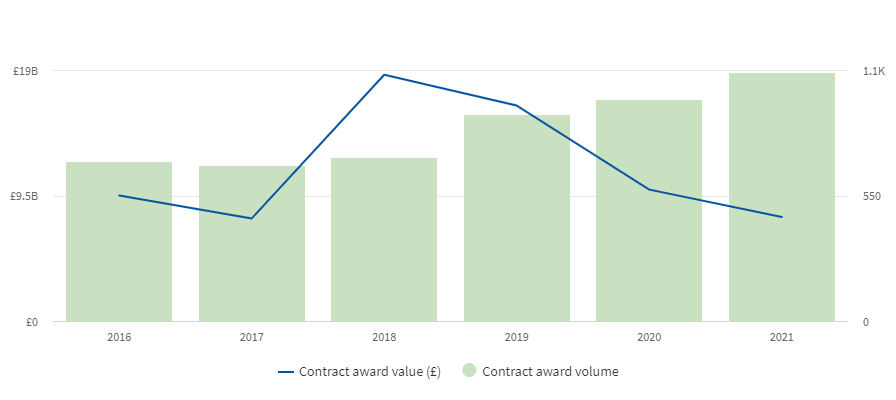

From 2016 - October 2021, the MOD awarded at least 5,070 contracts to over 2,000 suppliers, worth over £70 billion. This makes the MOD the largest public body by total contract award value, awarding over double the next largest body, the Department for Health and Social Care, over the same period.

As the above analysis shows, the total value of MOD contract awards peaked in 2018 at £18.6 billion before decreasing year on year, despite the volume of contract awards increasing. This indicates that while the number of contract opportunities with the MOD is increasing, their average value is gradually falling.

Over this period, the MOD's largest contract awards included:

|

Title |

Award Date |

Award Value |

Supplier(s) |

|

May 2018 |

£11.5bn |

Organisation for Joint Armament Cooperation |

|

|

September 2016 |

£3.5bn |

Boeing Defence UK |

|

|

December 2020 |

£3.4bn |

BAE Systems |

|

|

April 2017 |

£2.75bn |

Leidos Europe |

|

|

October 2018 |

£2.5bn |

Qinetiq |

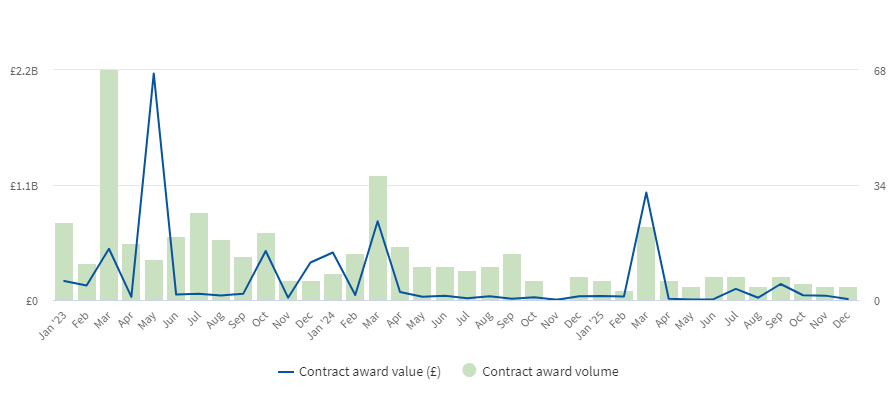

Tussell's platform identified over 460 likely-to-be-renewed contracts * - with a total award value of £7.11 billion - that are due to expire between 2023 and the end of 2025.

Notably, only 49 of these contracts - valued at £596 million - were call-offs from a framework. This indicates that upcoming opportunities with the MOD lie outside frameworks, making the MOD a favourable target if you're not currently on many or any frameworks.

The largest of these contracts - that are not call-offs - include:

|

Contract Title |

End Date |

Award Value |

Supplier(s) |

|

May 2023 |

£1.55bn |

United States Navy |

|

|

Land Equipment Service Provision and Transformation Contract |

March 2025 |

£937m |

Not listed. |

|

October 2023 |

£415m |

US Defence Department |

|

|

December 2023 |

£347m |

Rolls-Royce PLC |

|

|

May 2023 |

£334m |

Babcock Integrated Technology |

* "likely-to-be-renewed" = 'services' and 'supplies' contracts

Since 2016, the MOD has awarded contracts to over 2,000 suppliers.*

The MOD's largest suppliers - by total contract award value - were:

|

Supplier |

Sector |

Total Contract Award Value |

Largest Listed Contract |

Contract Value / Award Date |

|

Organisation for Joint Armament Cooperation |

Inter-governmental Body |

£11.5bn |

£11.5bn / May 2018 |

|

|

Boeing Defence UK |

Defence |

£6.12bn |

£3.5bn / September 2016 |

|

|

Devonport Royal Dockyard |

Shipbuilding |

£4.39bn |

£2.11bn / April 2019 |

|

|

Leidos Europe |

Logistics |

£3.65bn |

£2.75bn / April 2017 |

|

|

Qinetiq |

Defence |

£2.73bn |

£2.5bn / October 2018 |

* This figure includes subsidiaries.

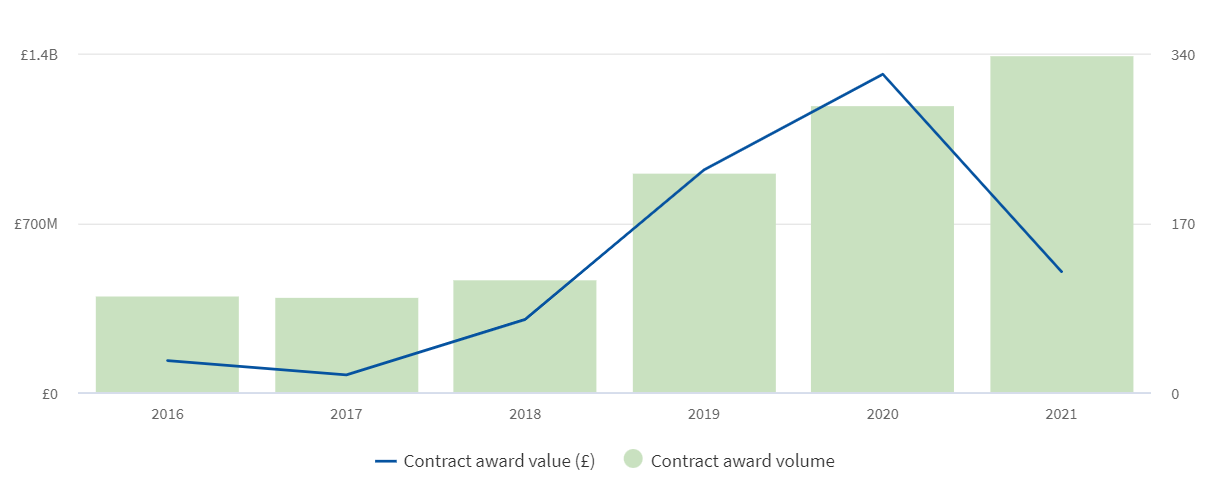

Below is a breakdown of the MOD's spend on IT and consultancy from 2016 - October 2021. This analysis was conducted using CPV codes, meaning the data may include some anomalous results.

IT and Software (CPV: 48000000, 72000000, 42960000)

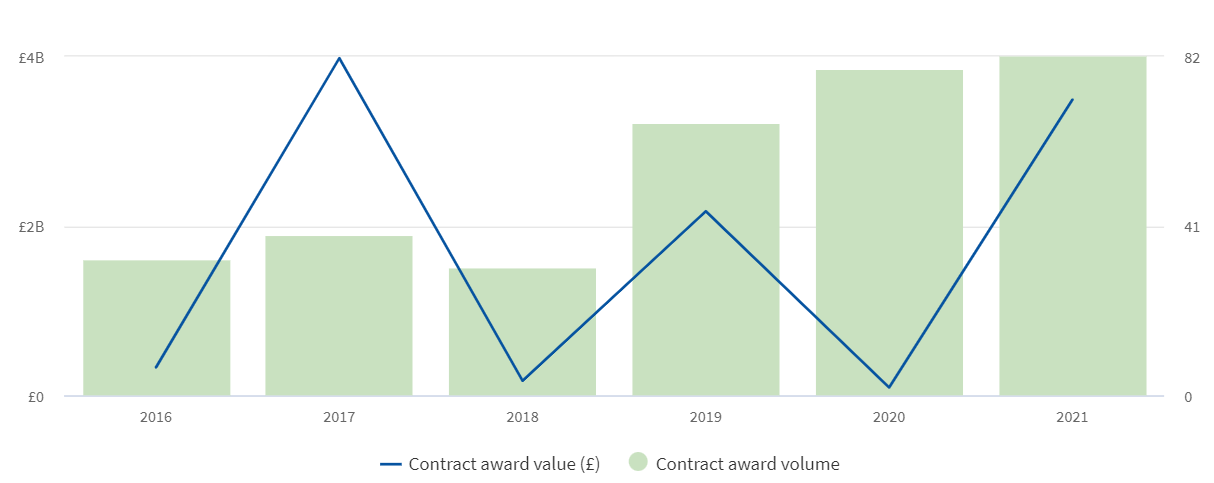

Since 2016, the MOD has awarded around 1,155 IT and software-related contracts, with a total award value of £3.24 billion.

As the above graph illustrates, both the quantity and total value of such contracts has increased year on year (excluding incomplete value data for 2021).

The largest suppliers in this sector - by total contract award value - were Boeing Defence UK (£536m), Boxxe (£298m), Shared Services Connected (£294m), IBM UK (£201m) and Capgemini UK (£193m).

The largest contracts in this period included:

|

Title |

Award Date |

Award Value |

Supplier(s) |

|

November 2020 |

£500m |

Boeing Defence UK |

|

|

Provision of Armed Forces Pay, Pensions and Military HR and Administrative Services |

December 2019 |

£294m |

Shared Services Connected |

|

June 2019 |

£191m |

Boxxe |

|

|

May 2020 |

£161m |

Capgemini UK |

Marketing, Recruitment, Consultancy (CPV: 79000000)

The MOD has awarded approximately £10.2 billion on marketing, recruitment and consultancy contracts since 2016, spanning over 300 contract awards and 200 suppliers.

As the above analysis indicates, though the quantity of consultancy related contracts awarded by the MOD has increased across the period, the value of these contracts varies considerably year on year.

The largest supplier in this sector by far was Leidos Europe (£3.65bn), followed by Capita Resourcing (£1.3bn), Vivo Defence Services (£1.12bn) and Hogg Robinson Travel (£450m).

The largest contracts in this sector included:

|

Title |

Award Date |

Award Value |

Supplier(s) |

|

April 2017 |

£2.75bn |

Leidos Europe |

|

|

Project Selborne - Provision of Training Service to the Royal Navy and Royal Marines |

January 2021 |

£1.3bn |

Capita Resourcing |

|

June 2021 |

£519m |

Vivo Defence Services |

|

|

March 2019 |

£450m |

Hogg Robinson Travel |

Of the 5,070 contracts awarded by the MOD from 2016 - October 2021, 940 have been identified as call-offs from a framework.

Using Tussell's frameworks analytics, we can see the total value of these call-offs sat at approximately £2.96 billion, and spanned 88 frameworks.

By value of identified call-offs, the MOD's most valuable frameworks are the Bulk Fuels Framework Agreement (£736m), Public Sector Travel and Venue Solutions (£450m), Public Sector Resourcing Award RM3749 (£375m) and RM3733 Technology Products 2 (£343m).

By the total count of identified call-offs, the MOD's most heavily utilised frameworks are RM3733 Technology Products 2 (123 call-offs), Bulk Fuels Framework Agreement (115 call-offs), G-Cloud 11 (78 call-offs) and G-Cloud 12 (78 call-offs).

Across this period, the MOD operated 116 frameworks of its own. The MOD called off approximately 185 contracts via these frameworks, with a total value of £810 million. The most valuable of these - by far - was the Bulk Fuels Framework Agreement.

*

As the largest public body by spend, the Ministry of Defence is a procurement titan. With a history of spending large sums on a huge array of clients, the MOD is a worthy target to sell your goods and services to.

This analysis only covers the surface of what Tussell's aggregated data platform can tell you about public sector. With Tussell, you can analyse spend, contract awards, favoured frameworks and more across the public sector, helping you make more informed decisions when selling to the public sector.

Book a demo with our team to see how Tussell can unlock insights for your public sector business strategy.

Find our other Buyer Profiles here:

.png?width=80&height=80&name=james%20v2%20(1).png)